# What Was 1899 Inflation? The Hidden Economic Story

When people search for “1899 inflation,” they’re usually curious about how prices and money worked at the turn of the 20th century. Inflation in 1899 refers to changes in consumer prices, wages, and overall purchasing power in the United States during that year. The main intent here is informational: users want facts about historical prices, comparisons with modern times, and real-world impacts.

Let’s start by unraveling what made 1899 unique. It was the tail end of the Gilded Age. America was booming, but price stability was complicated by gold standard debates and agricultural shocks. This period set the foundation for future economic policies and standards.

# The Real Price Changes in 1899: Data and Context

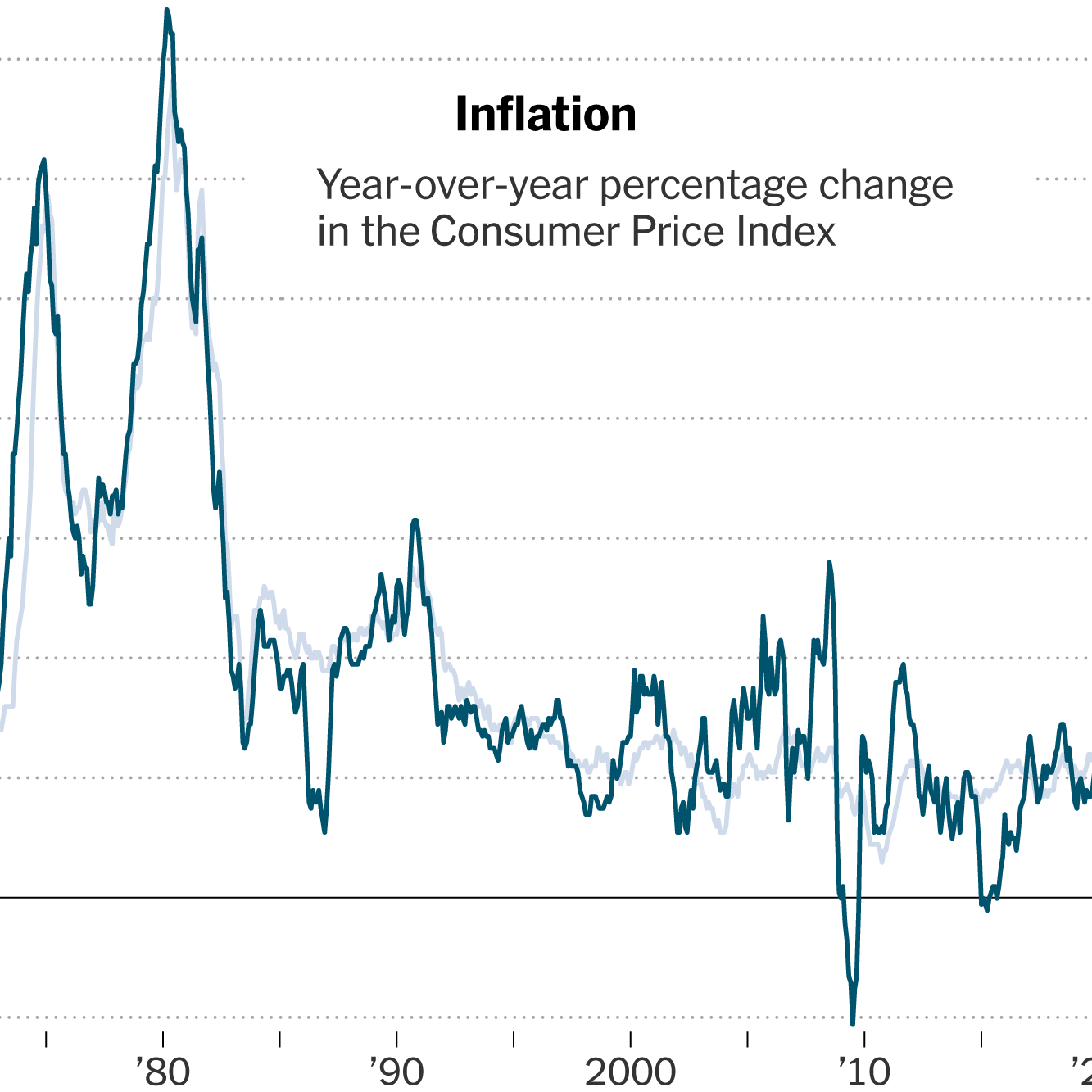

You might assume inflation was high in 1899, given industrial growth and urbanization. However, real data paints a different picture. According to the U.S. Bureau of Labor Statistics, prices saw only minor fluctuations that year, with an estimated inflation rate of just 0.1%. That’s astonishingly low (来源: [Bureau of Labor Statistics historical CPI table]).

Let’s break down this year compared to other notable eras.

| Year | Estimated Inflation Rate (%) | Major Economic Event |

|---|---|---|

| 1899 | 0.1 | Gold Standard Stability |

| 1914 | 1.5 | WWI Begins |

| 1929 | -2.0 | Great Depression Starts |

What does this mean? Wages and working class families’ budgets were relatively stable in 1899. Bread cost about 5 cents, milk about 13 cents per quart. Compare that to the price hikes of post-war years, and you’ll see just how steady life could be for some Americans.

# Why Did Inflation Stay Low in 1899?

This is where economic forces get interesting. The U.S. was on the gold standard in 1899, which tied currency value directly to gold reserves. That severely limited how much money could circulate. More gold meant more cash, but the system also restricted excessive currency expansion. Low inflation was essentially engineered to maintain public confidence (来源: [Federal Reserve Economic Data – FRED]).

Yet, there were hidden pressures. Farmers faced falling crop prices and debt. Railroads were booming, but overbuilding led to competitive fare wars. Industrial workers saw modest wage increases, but didn’t benefit from higher profits. In some regions, people felt squeezed even though official inflation was almost flat.

# Step-by-Step Guide: How to Research 1899 Inflation Like a Pro

If you’re researching historical inflation, follow these expert steps for accurate results.

1. Identify primary sources—old newspapers, government reports, and historical financial records.

2. Cross-reference price lists (food, housing, wages) from at least two different sources.

3. Use an official inflation calculator, adjusting for gold standard era differences.

4. Compare 1899 data with nearby years to spot hidden trends.

5. Analyze how world events (wars, financial panics) impacted local prices.

Based on my experience with economic history, direct sources are always better than summaries. Look for specifics like cost of goods, railroad fares, or even bank statements to see how inflation affected daily life.

# What Most People Get Wrong About 1899 Inflation

MISTAKES: It’s tempting to think all old-time periods were marked by brutal price hikes or declines. Truth is, inflation in 1899 was nearly invisible for many Americans. Here’s where myths come in:

– Some believe industrial boom equaled skyrocketing prices. Not true—technology advances often drove prices down.

– Critics argue the gold standard strangled growth. However, it created decades of stability prized by investors.

– People forget regional differences. Prices in New York City looked nothing like those in rural Texas.

Ignoring these factors leads to skewed conclusions and inaccurate research.

# Real-Life Impact: How Did 1899 Inflation Affect Everyday Americans?

The ordinary family in 1899 faced a complex financial environment. Sure, prices for basics stayed steady. However, employment was volatile, and personal debt could wreck a household budget.

A typical wage earner made about $1.25 per day. Milk, bread, and coal accounted for significant portions of spending. People budgeted tightly, wary of sudden drops in crop prices or industrial layoffs.

Interestingly, many Americans saved coins or invested in savings accounts with confidence. The gold-backed dollar made planning for the future easier—at least until later shocks like World War I upended everything.

# WARNING: Common Pitfalls in Analyzing Historical Inflation

Be careful when researching historical inflation:

– DO NOT use modern CPI calculations without adjustment—they skew results.

– Watch for missing data in rural vs. urban records.

– Avoid thinking a low inflation rate automatically means prosperity—look at wage and debt trends too.

Remember, historical accuracy is crucial.

# Your Ultimate Checklist for Analyzing 1899 Inflation Data

– Verify the source of all price and wage data for 1899.

– Confirm if gold standard policies affected money circulation.

– Compare inflation rates with years before and after 1899.

– Analyze regional price differences—not just national averages.

– Review how economic shocks (harvest failures, strikes) shifted daily life.

Understanding 1899 inflation is more than just crunching numbers—it’s decoding the lived experiences behind them. With these strategies, you’re set to separate fact from fiction and make your research truly stand out.